What Is a Spread?

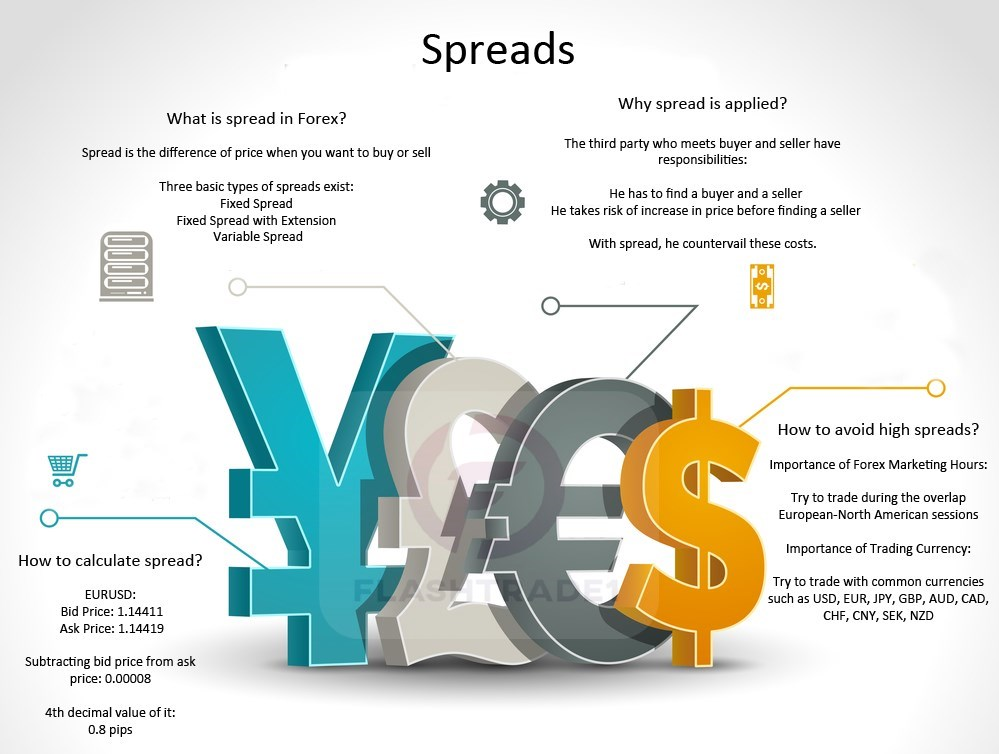

A spread can have numerous definitions in financing. Basically, nevertheless, they all refer to the distinction between 2 prices, rates or yields. In one of the most common definitions, the spread is the gap between the bid and the ask prices of a security or asset, like a stock, bond or commodity This is called a bid-ask spread.

KEY TAKEAWAYS

» In finance, a spread describes the difference between 2 rates, prices or yields

» One of the most usual kinds is the bid-ask spread, which refers to the gap between the bid (from buyers) and the ask (from sellers) prices of a security or asset

» Spread can also describe the difference in a trading setting– the gap in between a short position (that is, selling) in one futures contract or currency and a long position (that is, buying) in another.

How is the Spread in Forex Trading Measured?

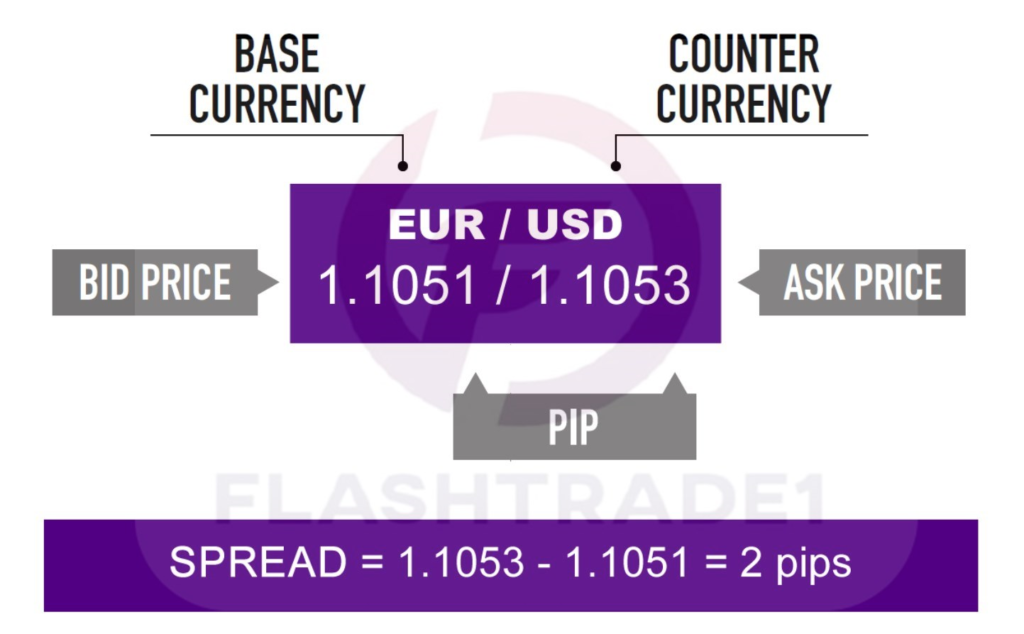

The spread is usually measured in pips, which is the smallest unit of the price movement of a currency pair.

For most currency pairs, one pip is equal to 0.0001.

An example of a 2 pip spread for EUR/USD would be 1.1051/1.1053.

TYPES OF SPREAD

The type of spreads that you’ll see on a trading platform depends on the forex broker and how they make money.

There are two types of spreads:

» Fixed

» Variable (also known as “floating”)

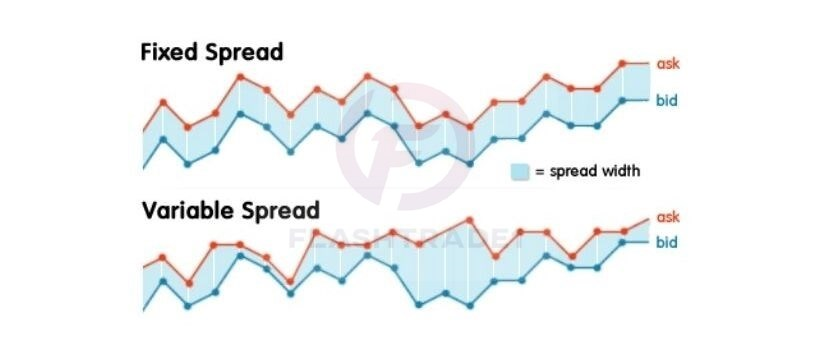

Fixed Spreads in Forex

As the name pretty much suggests, Fixed spreads remain the same regardless of the condition of the market. Be it a volatile or non-volatile market, the spread always stays the same.

As mentioned, these spreads are usually offered by Market Makers type of brokers.

Dealing Desk brokers buy a large number of positions from their liquidity providers and then offer these positions to traders (clients). Since the brokers will own these positions, they can control and display the prices to their clients with a fixed spread.

Variable Spreads in Forex

Again, as the name suggests, Variable spreads are the spreads that are constantly changing, just like the exchange rates. That is, as and when the bid and ask price changes, the difference between the two changes. This, therefore, changes the spread as well.

This type of spread is offered by Non-Dealing Desk brokers. These brokers obtain the prices from multiple liquidity providers and directly pass on these prices to the traders without the involvement of a dealing desk. This means that NDD brokers do not have control over the spreads. It all depends on the market’s supply and demand and its overall volatility.

As a typical tendency of the market, when there is an economic event, the spreads widen. And same is the case when the market volatility drops.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com