What is a Lot in Forex?

Among the essential terms that you are bound to come across time and again in forex trading is “lot”. Here we will have a look in more information about what exactly a lot remains in forex so the next time you are trading lots, you will understand precisely what is entailed.

Beyond that, we will likewise look at the different kinds of forex lots you can come across when trading with your leading forex broker. Some of these will be more preferably matched to brand-new traders or those who numerous wish to guide a little on the much safer side when it concerns risk management in trading.

Forex Lot Types Explained

In the most basic of forms, the forex lot as you understand it in forex trading, is simply a measurement of currency systems and a way of identifying the number of currency units are required for a trade.

Forex lots and the terminology around lot trading is commonly used still amongst almost all of the leading trading brokers in the sector. Despite the fact that a few now allow for more versatile trading styles, mention of forex lots is still really common. You will also hear a lot of mention of forex lot, and lot trading if you are checking and choosing a brand-new broker out some of the very best forex broker evaluations.

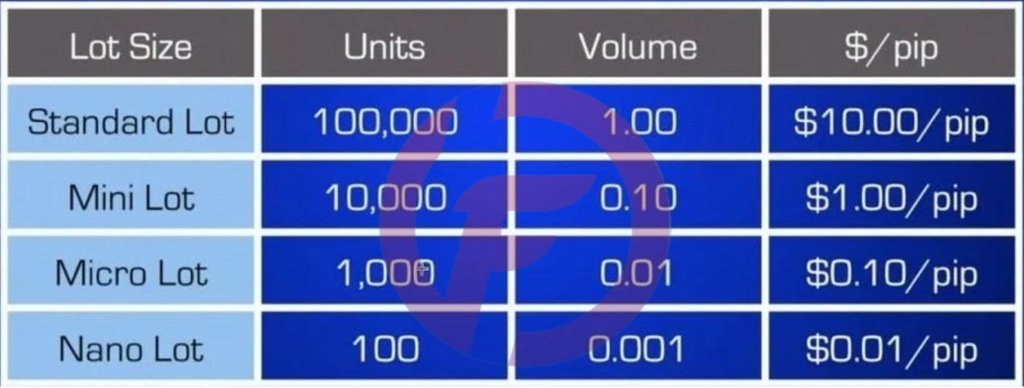

With that in mind then, there are usually 4 forex lot sizes that you will come across when trading forex.

Requirement Lot– 100,000 Currency Systems

The basic forex lot is what you will see most frequently when trading with the standard account kinds of lots of forex brokers. The basic lot is 100,000 currency units, so usually has a worth of $100,000 if we take trading in US Dollars as an example.

The majority of skilled forex traders are accustomed to trading at this level and it is worth keeping in mind that due to take advantage of in forex, you do not require to have a full $100,000 in your account to trade a basic lot. When most describe a lot in forex trading, this is likewise the typical worth they are referring to.

Mini Lot– 10,000 Currency Systems

A small forex lot is a great choice for those who may want to trade with a lower, or maybe no utilize at all. This kind of lot is again extremely common with a lot of leading forex brokers offering these types of lots which contain 10,000 currency systems which would have a normal value of $10,000 if trading USD.

Even though they are referred to as “mini” lots traded at this level still represent a really considerable investment for lots of traders.

Micro Lot– 1,000 Currency Units

A micro lot in forex is the next smaller step on the trading ladder once again. While micro lots and forex micro trading accounts are readily available with some brokers, they are not always accessible.

Nano Lot– 100 Currency Systems

The tiniest trading lot size available is the nano lot. This trading lot is consisted of 100 currency systems which have a total value of $100 in the case of our USD trading example. The nano lot is once again more uncommon to see, but is definitely still available with lots of leading forex trading brokers. This is a very perfect starting lot size for those who wish to check out forex trading for the very first time. It provides real cash trading beyond a demonstration trading account, however with a much smaller sized level of threat included.

Forex Lot Differences Between Brokers

Similar to whatever, there is some room for variation within the forex trading sector. The terms explained above are normally used by both traders and brokers across the board. You will in some cases see lots explained in decimal terms in contrast with a standard forex lot as follows:

Mini Lot: 0.1 Basic Lots

Micro Lot: 0.01 Standard Lots

Nano Lot: 0.001 Basic Lots

This is exactly the same thing in the majority of cases. Many brokers likewise make “cent accounts” offered that typically cater for the smaller lot sizes in micro lots and possible nano lots. There are likewise a couple of brokers that will permit trading with as little as 1 currency system ($ 1).

Which Lot Size is Best?

The forex lot size that works well for you is really based on a number of elements based upon how you want to trade. Among these is just how much you need to run the risk of, and how much of your capital you really wish to run the risk of. When you have actually decided this, you will be better placed to pick the ideal lot size for you. You need to also keep in mind that you can still engage take advantage of when trading with smaller sized lot sizes, though the ratio will not increase.

Usually, as you get more experience in the forex trading industry, your attitude and desire to take on a little more threat lends itself well to increasing lot size. With this in mind then, lots of would suggest finishing from demo account use to a nano or micro lot size.

Forex lots and the terms around lot trading is extensively utilized still among practically all of the top trading brokers in the sector. You will likewise hear plenty of reference of forex lot, and lot trading if you are checking and choosing a new broker out some of the finest forex broker evaluations.

The smallest trading lot size offered is the nano lot. You will in some cases see lots described in decimal terms in comparison with a standard forex lot as follows:

Many brokers also make “cent accounts” readily available that typically cater for the smaller lot sizes in micro lots and possible nano lots.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com