What is a Currency Pair?

The first step to becoming a successful forex trader is understanding what currency pairs are and how they work. Luckily for you, you can find all that information here. This page explores how currencies work in relation to forex trading, the different types of currency pairs, and how to choose which pairs to trade.

A currency pair involves two currencies and represents the value of one currency against another. In forex trading, the changing value of a currency pair provides traders with the opportunity to make a profit.

Read on for a more in-depth look into the different types of currency pairs and to discover which currency pairs are suited to your trading style and skill level.

Currency Pair Trading Takes Place in the Foreign Exchange Market

Currency pair trading takes place within the foreign exchange market (usually abbreviated to forex market), the largest and most liquid financial market in the world with a trading volume of over $5 trillion per day on average – for perspective this is around 25 times higher than global equity trading volumes.

While the factors driving buying and selling decision within the foreign exchange market is beyond the scope of this article, suffice it to say that as with any market, prices are driven by the age-old supply and demand dynamic with higher demand / lower supply pushing prices up while lower demand / higher supply leads to depreciation.

The foreign exchange market affords investors the opportunity to buy, sell, exchange and speculate on currency market movements 24 hours a day, 5 days a week (for retail investors) from Sunday 1000 GMT to Friday 1000 GMT. It’s a fairly common misconception that markets ‘close’ for the weekend however commercial flows continue – which is why you might see a bearish or bullish gap when markets reopen on Sunday.

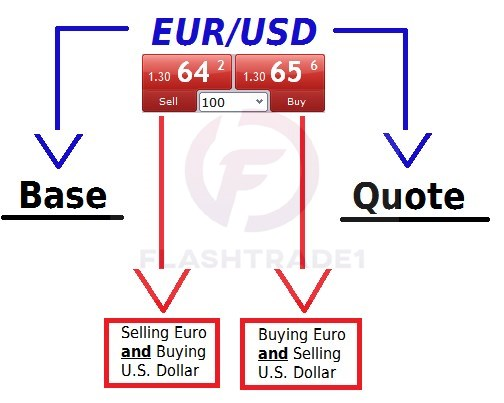

So how do currency pairs come into it? While it’s easy and for the sake of simplicity it makes sense to consider a currency pair a single unit, all forex trading involves the simultaneous purchase of one currency (the base currency in the forex pair) and sale of another (the quote currency).

The Simplest Explanation You’ll Ever Get

Trading, in any respect, centers around speculating how the price of a specific asset will move. With stock market trading, for example, a trader might buy the shares of a company they believe will rise in value and then sell them at a higher price to make a profit.

The same applies to forex trading, except that you are buying a currency instead of a company share. With stocks, you are exchanging money for shares, whereas in forex trading, you are exchanging one currency for another.

The two currencies involved in this exchange are grouped into a currency pair. If you are trading EUR/USD, for example, you are exchanging euros for US dollars.

The exchange rate, or price, represents how much one currency is worth compared to the other. If the EUR/USD is trading at a price of 1.1015, that means that one euro is worth $1.1015.

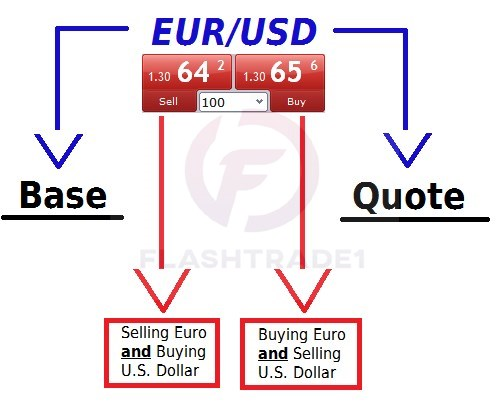

how to use Currency Pairs:

- A pair is listed using two different currencies in a given order

- The first currency listed is the “Base” Currency

- The second currency listed is the “Quote” Currency

- Whatever action you take on the pair Directly affects the Base Currency and Inversely effects the Quote currency

- You are always buying one currency AND selling one currency when you make a trade

Major, Minor and Exotic Currency Pairs

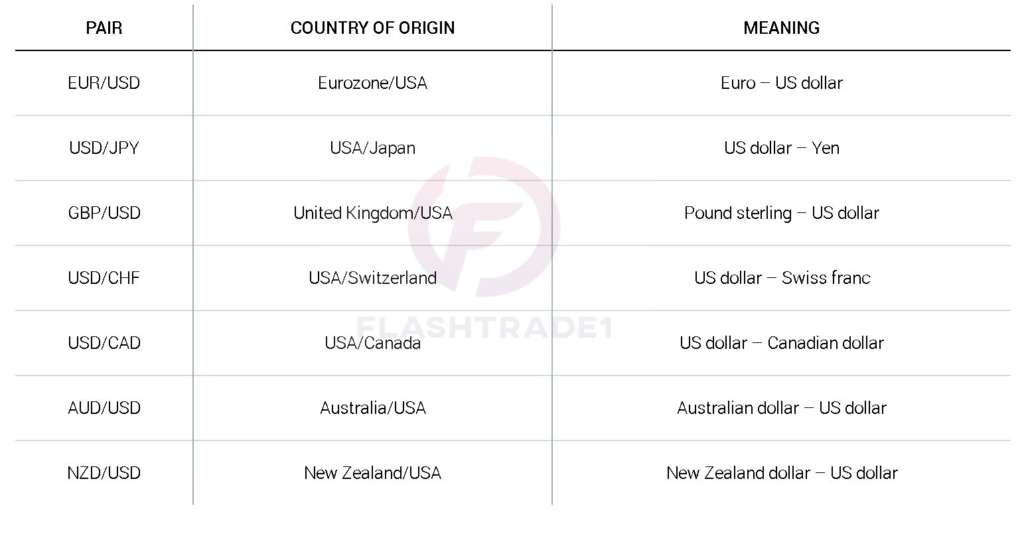

Major Currency (Forex) Pairs

Major currency pairs are those which see the highest trading volumes and all include the US Dollar – the world’s largest reserve currency.

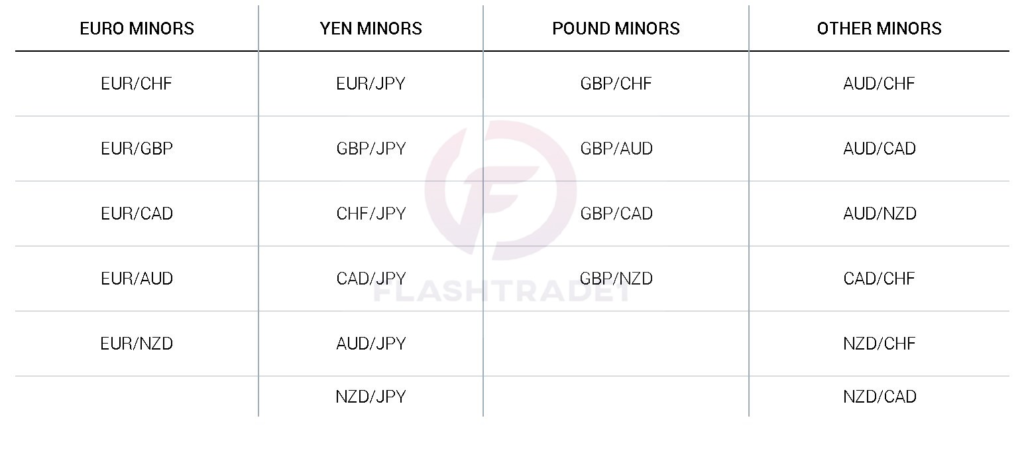

Minor Currency Pairs / Crosses

Minor currency pairs are the most commonly traded developed market currencies – not including the US Dollar with the Euro, Japanese Yen and British Pound the most traded currencies within the group.

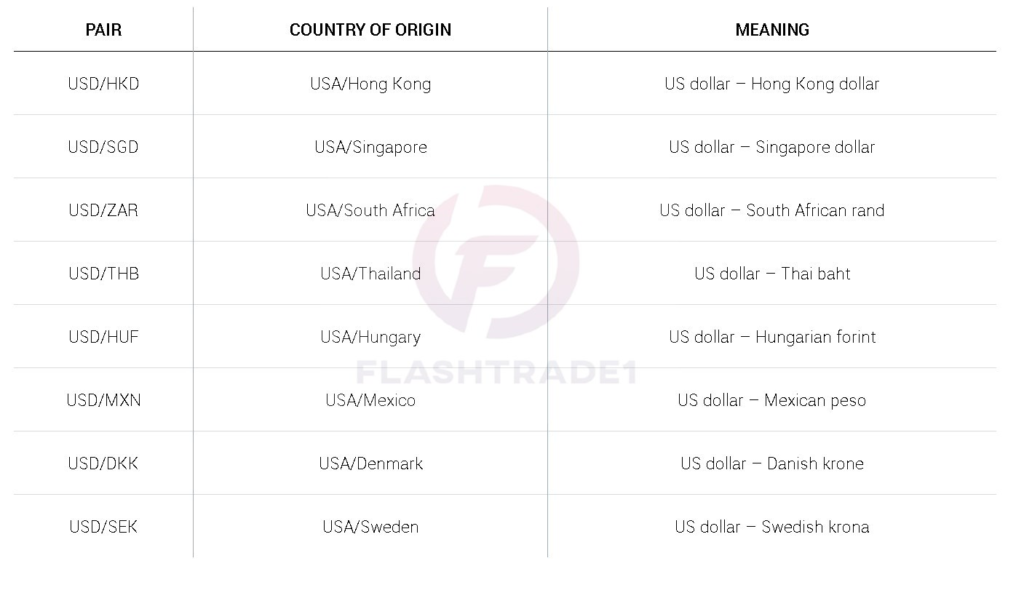

Exotic Currency (Forex) Pairs

Exotic currency pairs are made up of one major currency as the base, coupled with any non-major or emerging market currency, such as the South African Rand (ZAR), Mexican Peso (MXN), or Singapore Dollar (SGD). The below is but a few of the literally thousands of tradeable exotics.

The Dollar Real (USD/BRL)

Like many other currencies from emerging markets, there is always a significant risk in trading them. Currency manipulation, social unrest, and political problems are all issues that can arise unexpectedly.

For example, in 2012, the Brazilian government took direct action to depreciate the real against the US dollar, which led to a drop of 10%. In other words, trading exotic currencies is not for beginners because your analysis can easily be compromised by unforeseen events.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com