The Foreign Exchange Interbank Market

The forex market (forex) has an ordinary day-to-day trade volume of $5 trillion, making it the largest market in the world. Market individuals consist of foreign exchange brokers, hedge funds, retail investors, firms, reserve banks, federal governments, as well as institutional capitalists such as pension plan funds.

All of the interbank trading activity affects the need for currencies and also their exchange rates. Nonetheless, the main market makers, which are the huge financial institutions that execute a considerable quantity of the forex trading quantity, provide the baseline currency exchange rate that all other profession pricing is based upon.

KEY TAKEAWAYS

» The interbank foreign exchange market includes key market makers, which are huge financial institutions that trade a substantial amount of the market’s volume.

» The foreign exchange market is a decentralized market, indicating there isn’t one “exchange” where every trade is recorded.

» The interbank bid-ask prices form the basis for the market’s currency rates where pricing is figured out for all other individuals.

Understanding the Forex Interbank Market

A foreign exchange rate is the cost or rate demonstrating how much it set you back to acquire one currency in exchange for another currency. Forex investors deal currencies in the hopes that the currency exchange rate will certainly relocate their favor. For example, a trader may purchase euros versus the U.S. dollar (EUR/USD) today at the current exchange rate (called the spot rate) and also relax the trade with a countering profession the next day. The distinction in between both currency exchange rate represents the gain or loss on the profession.

As an example, let’s state that an investor acquired euros (went long) versus the UNITED STATE bucks today at a rate of $1.10 for every euro. The next day, the trader relaxed the setting with a countering sell profession at $1.12; the difference being the gain on the profession. Nevertheless, not all currency transactions involve speculation. Business, for example, buy and sell products overseas, and in doing so, frequently need to purchase or trade their local currency for an international money to assist in the purchase.

Decentralized Market

Unlike many other exchanges, such as the New York Stock Exchange (NYSE) or the Chicago Board of Trade (CBOT), the forex (or FX) market is not a central market. In a central market, each purchase is taped by rate and also volume. There is generally one central location back to which all trades can be mapped, and also there is usually a centralized network of market makers.

Nonetheless, the forex or currency market is a decentralized market. There isn’t one “exchange” where every profession is taped. Trading occurs all over the globe on several exchanges without the solitary characterization of an exchange listing. Likewise, there is no clearinghouse for FX deals. Instead, each market maker or financial institution records and also keeps their own professions.

Trading in a decentralized market has its benefits and also drawbacks. In a centralized market, traders can monitor quantity in the overall market. However, in times when trading volume is thin, huge multi-billion-dollar transactions can affect rates disproportionately. On the other hand, in the foreign exchange market, professions are made in the certain time zones of that particular region. As an example, European trading opens in the morning hours for U.S. investors, while Asia trading opens after the close of the U.S. trading session. As a result of the currency market’s 24-hour cycle, covering numerous trading sessions, it’s difficult for one large trade to control a currency’s cost in all three trading sessions

Regulators

The worldwide nature of the interbank market can make it hard to regulate. However, with such vital gamers in the market, self-regulation is often even more efficient than federal government policies. For private forex financial investment, a forex broker have to be registered with the Asset Futures Trading Commission (CFTC) as a futures payment seller and also belong to the National Futures Organization (NFA). The CFTC regulates brokers to make sure that they meet stringent monetary standards.

Interbank Bid-Ask Prices

Money are priced quote in pairs using two various prices, call the bid as well as ask cost. The proposal and ask costs resemble how equities are traded. The proposal cost is the rate you would get if you were offering the money and the ask rate is the rate you would certainly get if you were acquiring the currency. The distinction in between the proposal and ask rates of a currency is known as the bid-ask spread, which represents the cost of trading currencies minus broker costs and also payments.

The key market makers that make the quote and also ask spreads in the currency market are the biggest banks in the world. These banks deal with each other constantly either in support of themselves or their customers– as well as they do so with a subsegment of the foreign exchange market known as the interbank market.

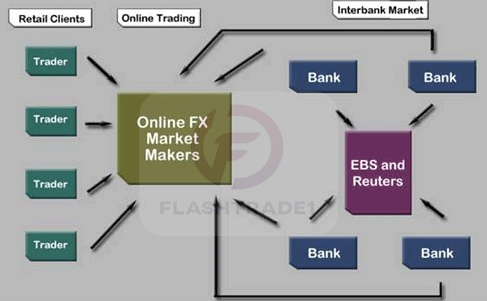

The interbank market incorporates aspects of interbank professions, institutional investing, as well as trades from companies via their financial institutions. The deal rates from all of these players and their purchases develop the basis for dominating money rates– or the marketplace– where rates is figured out for all various other individuals. The competitors between the interbank establishments makes sure tight bid-ask spreads as well as reasonable prices.

Individual Forex Investors

Most individuals can not access the rates available on the interbank forex market considering that their purchase size isn’t huge sufficient to be traded by the interbank players. In other words, the forex market is a volume-discounted company, suggesting the larger the profession, the closer the rate will certainly be to the interbank or market rate.

Nevertheless, the interbank participants are necessary to retail financiers considering that the even more players included, the more liquidity exists in the market, and the greater probability for rate fluctuations, which can result in trading opportunities. The included liquidity likewise allows retail financiers to get in and also out of their trades with ease considering that there’s so much quantity being traded.

The Interbank Players

A lot of the overall foreign exchange quantity is transacted via concerning 10 financial institutions. These financial institutions are the brand names that we all recognize well, consisting of Deutsche Bank (NYSE: DB), UBS (NYSE: UBS), Citigroup (NYSE: C), and HSBC (NYSE: HSBC).

Federal government and reserve banks have a few of their own centralized systems for forex trading but likewise make use of the world’s biggest institutional financial institutions as well. The elite group of institutional investment financial institutions is primarily in charge of making costs for the bank’s interbank and institutional clients and for balancing out that danger with other clients on the opposite side of the profession.

Each financial institution is structured differently, but a lot of banks will certainly have a separate team known as the Forex Sales and Trading Department. The sales as well as trading desk is generally in charge of taking the orders from the client, obtaining a quote from the area investor and also relaying the quote to the client to see if they intend to deal on it. Although on the internet fx trading is ending up being much more typical, lots of firms still deal directly with an FX expert on a trading work desk of a banks. The experts likewise give threat monitoring strategies for companies designed to alleviate negative motions in currency exchange rates.

Usually, on the bigger trading desks, a couple of market manufacturers may be in charge of each currency pair. As an example, one trader could deal in EUR/USD while an additional take care of Oriental currencies such as the Japanese yen. The Australian buck dealer might additionally be responsible for the New Zealand dollar while there might be a separate dealer making quotes for the Canadian buck.

Institutional traders typically do not allow for customized going across. Forex interbank work desks normally deal just in the most preferred currency pairs (called the majors). Furthermore, trading units may have a marked dealer that is accountable for the unique money or exotic money professions such as the Mexican peso and the South African rand. Much like the foreign exchange market thoroughly, the forex interbank market is offered 24-hour.

How Interbank Pricing is Figured Out

Financial institution dealers will identify their prices based upon a selection of variables, consisting of the current market price as well as the quantity readily available (or liquidity) at the existing price level. If liquidity is slim, a trader might be hesitant to take on a setting in a money that would be difficult to loosen up if something went wrong in the marketplace or with that said country. If an investor takes on a position in a slim market, the spread will commonly be broader to make up for the risk of not having the ability to leave the position promptly if an adverse occasion occurs. This is why the foreign exchange market typically experiences larger bid-ask spreads at particular times of the day as well as week, such as a Friday afternoon before the U.S. markets close or previously vacations.

An interbank trader likewise thinks about the bank’s forecast or sight on where the currency pair could be headed and also their supply placements. If the dealer believes that the euro is headed greater, as an example, they may want to offer a much more affordable rate to customers who want to offer them euros because the supplier thinks that they can keep the euro placement for a couple of hours and publication a balancing out trade later in the day at a better price– making a couple of pips in profit. The flexible nature of market prices is something that is distinct to market manufacturers that do not supply a repaired spread.

Deal Operating Systems and also Credit Risk

Similar to the way we see rates on a digital forex broker’s system, there are 2 key platforms that interbank investors utilize: One is supplied by Reuters Dealing, as well as the various other is provided by the Electronic Brokerage Solution (EBS).

The forex interbank market is a credit report approved system in which banks trade based only on the credit history connections they have actually developed. All of the banks can see the most effective market rates currently readily available. However, each bank must have an authorized connection to trade at the rates being provided. The bigger the banks, the a lot more credit score relationships they can have, and also the much better pricing they will have the ability to accessibility. The very same holds true for clients, such as retail forex brokers. The larger the retail foreign exchange broker in terms of funding readily available, the much more beneficial pricing it can get from the foreign exchange market.

Both the EBS and Reuters Dealing systems supply trading in the major money sets, yet certain money sets are more liquid and also raded extra often. These 2 firms are constantly attempting to catch each other’s market share, yet likewise have certain money pairs that they concentrate on.

Cross-currency sets are typically not priced estimate on either system, but are calculated based upon the prices of the significant currency sets and then balanced out through the legs. For example, if an interbank investor had a customer who wanted to go long EUR/CAD, the trader would certainly more than likely buy EUR/USD over the EBS system and also purchase USD/CAD over the Reuters system. The trader after that would increase these prices and supply the client with the corresponding EUR/CAD price. The two-currency-pair purchase is the reason why the spread for currency crosses, such as the EUR/CAD, tends to be larger than the spread for the EUR/USD as well as often much less typically traded.

The minimum deal dimension of each unit of profession is about 1 million of the base currency. The typical one-ticket deal dimension tends to be 5 countless the base currency. Nevertheless, the foreign exchange interbank market usually has clients that trade between $10 million and also $100 million. These sorts of customers are trading for institutional portfolios or multinational corporations.

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com