How to Determine the Minimum Capital to Start Day Trading Forex

Due to the fact that the foreign exchange (forex) market is one of the most available monetary markets, it’s easy to begin day trading currencies. Some forex brokers require a minimum preliminary deposit of just $50 to open an account, while others permit you to open accounts with no preliminary deposit.

It is possible to take a set quantity of capital and begin trading. There are numerous factors to consider when figuring out how much you need to begin day trading on the forex market.

Minimum Capital for Day Trading Forex

If you should begin trading right away, you can begin with $100. For a little more flexibility, $500 can give a little more income or returns. However, $5,000 might be best due to the fact that it can help you produce a reasonable quantity of earnings that will compensate you for the time you’re investing in trading.

Set amounts don’t assist you understand the minimum amount needed for your trading desires, life circumstances or risk tolerances. You ought to comprehend the dangers that are involved in trading forex and understand how to reduce them.

It’s also important to know how forex trades are made and what they include so that you can much better gauge your capability to stand up to losses on your method to making gains.

Understand the Threats

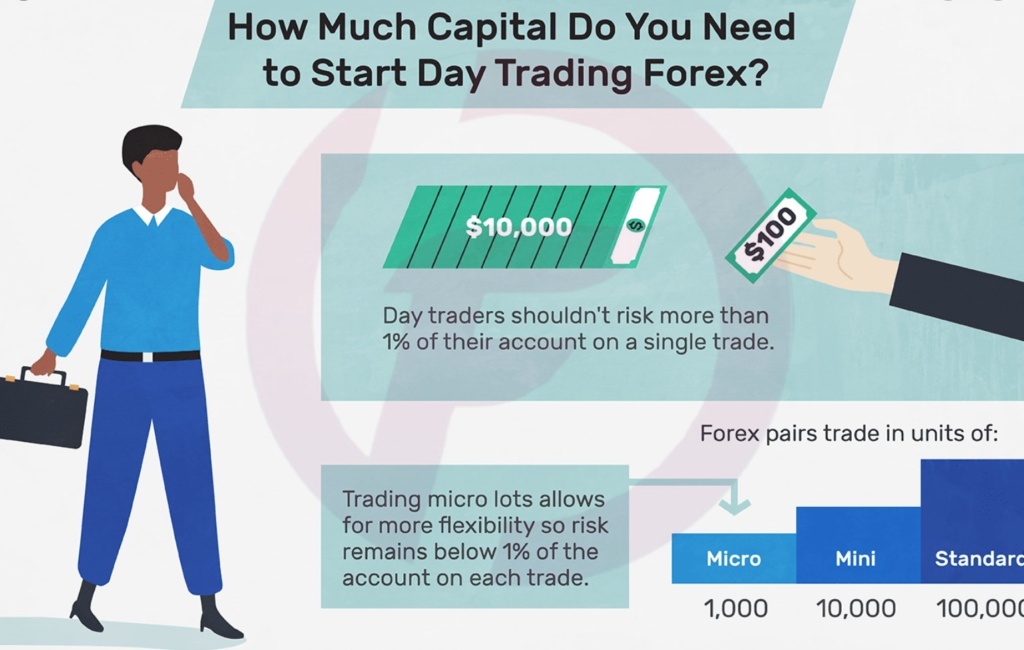

Since day trading has to do with trading on stock rate changes, most of the risk taken on remains in the form of costs stagnating the method you believed they might go. This happens typically, so day traders should not risk more than 1% of their forex account on a single trade.

Trading Dangers

Leveraged trading and minimal trading are when you utilize forms of debt to fund your trades. Both increase the quantity of risk you take substantially and increase the possibility of owing much more than you did.

Trade danger, concerning the cash you run the risk of in one trade and not the risks discussed formerly, is the quantity of capital you could lose. It is figured out by finding the distinction between your entry rate and the cost at which your stop-loss order goes into result, multiplied by the position size and the pip value.

Danger Management

While you can use utilize to fund your trades and succeed, the threats are so high that the very best method to handle the risks involved is not to use leverage-based trading.

The 1% rule is among the very best methods for reducing trade danger. If your account contains $1,000, then the most you’ll want to run the risk of on a trade is $10. You should not run the risk of more than $100 per trade if your account has $10,000.

Find Out Lot Sizes and Pip Worths

When you sell or buy forex, rates relocate pips, and the amounts are sold in lots. The relationship between the two is essential for establishing your minimum quantity.

Lots

Forex sets trade in systems of 1,000 (micro), 10,000 (mini) or 100,000 (requirement) lots. When USD is noted second in the pair– such as EUR/USD– and you fund your account with U.S. dollars (USD), the worth of the pip per type of lot is fixed in USD.

Each pip motion is worth $0.10 if you hold a micro lot of 1,000 units. If you hold a mini lot of 10,000, then each pip relocation is $1. If you hold a standard lot of 100,000, then each pip relocation is $10.

Pips

The forex market moves in pips, which means percentage in point or price interest point. A pip is the tiniest quantity a currency can change. For example, in many currency sets, a pip is 0.0001. This is equivalent to 1/100th of a percent.

That’s a one pip relocation if the EUR/USD rate modifications from 1.3025 to 1.3026. That’s a 100 pip relocation if it changes to 1.3125.

An exception to the pip worth “guideline” is the Japanese yen. A pip for currency sets in which the yen is the second currency– called the quote currency– is 0.01, comparable to 1%.

Develop Stop-Loss Orders

When trading currencies, it’s necessary to enter a stop-loss order. Stop-loss orders immediately avoid significant losses if the base currency moves in the opposite instructions of your bet. An easy stop-loss order could be 10 pips below the current rate when you expect the cost to rise or 10 pips above the existing cost when you expect the cost to fall.

This approach depends upon the quantity you’ve limited yourself to trade with. A stop loss of 10 pips below could be a substantial amount of money– if one EUR/USD pip costs $10, a 10 pip movement down might cost you $100 on one basic lot.

Determine Your Minimum Capital for Trading

It helps to see how various trading amounts can influence your minimum amount for day trading. The previous examples of $100, $500, and $5,000 are exceptional for seeing the differences and resolving the calculations to discover your limitation.

$100 in the Account

Presume you open a represent $100. You will want to restrict your threat on each trade to $1 (1% of $100).

Trade Threat = pips x pips value x nember of lots

If you place a trade in EUR/USD, purchasing or offering one micro lot, your stop-loss order should be within 10 pips of your entry cost. Considering that each pip is worth $0.10, if your stop loss were 11 pips away, your threat would be $1.10 (11 x $0.10 x 1), which is more danger than your strategy permits.

$500 in the Account

Now presume you open an account with $500. You can run the risk of up to $5 per trade and purchase several lots. For instance, you can set a stop loss 10 pips far from your entry rate and buy five micro-lots. Due to the fact that 10 pips x $0.10 x 5 micro lots = $5, you ‘d still be within your threat limit.

Or, if you pick to position a stop loss 25 pips far from the entry rate, you can buy two micro lots to keep the danger on the trade listed below 1% of the account. Due to the fact that 25 pips x $0.10 x 2 micro lots = $5, you would buy just two micro lots.

Beginning with $500 will offer greater trading versatility and produce more daily income than $100. However many day traders will still be able to make just $5 to $15 each day off this amount with any consistency.

$5,000 in the Account

You have even more versatility and can trade mini lots as well as micro-lots if you start with $5,000. You might purchase 6 mini-lots and two micro-lots if you purchase the EUR/USD at 1.3025 and place a stop loss at 1.3017 (8 pips of threat).

Your maximum danger is $50 (1% of $5,000), and you can sell mini lots since each pip is worth $1, and you’ve picked an eight pip stop-loss. Divide the threat ($50) by (8 pips x $1) to get 6.25 for the variety of mini lots you could buy without exceeding your danger. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro-lots (2 x $0.10 x 8 pips = $1.60), which puts an overall of only $49.60 at risk.

With this amount of capital and the capability to run the risk of $50 on each trade, the earnings potential go up, and traders can possibly make $50 or more daily, depending upon their forex method and cost modifications.

An easy stop-loss order could be 10 pips listed below the present rate when you expect the rate to increase or 10 pips above the existing rate when you anticipate the cost to fall.

You ‘d still be within your risk limit since 10 pips x $0.10 x 5 micro lots = $5.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots since each pip is worth $1, and you have actually selected a 8 pip stop-loss. Divide the threat ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you might buy without exceeding your danger. You would break up 6.25 mini lots into six mini lots (6 x $1 x 8 pips = $48) and 2 micro-lots (2 x $0.10 x 8 pips = $1.60), which puts an overall of just $49.60 at risk.

WHERE TO CONTACT US

Website : www.flashtrade1.com

Twitter : twitter.com/flashtrade11

Telegram : telegram.me/ft113

Facebook : www.facebook.com/FlashTrade1

Instagram : www.instagram.com/flashtrade1/

You-Tube : www.youtube.com/FlashTrade1

Skype : flashtrade1@outlook.com

Mail ID : info.flashtrade@gmail.com