How Big is the Forex Market?

The global forex market has an average daily turnover of approximately US $5 trillion

The US dollar accounts for approximately 87.8% of total daily forex trading

The UK was the most popular country for Forex trading in 2016, with US $2.4 trillion traded on average each day

The fx, or forex market, is without inquiry among the largest and also busiest financial markets worldwide. With forex trading happening around the clock, from when investors in London go to sleep on Sunday evening, to when investors in Asia wake up on Saturday morning, the forex market can truly be called the marketplace that never sleeps.

To give some indicator on the sheer size of it, in 2016 the foreign exchange market had an average turnover of over United States $5 trillion, every day.

These stats, and those to follow, are based upon one of the most comprehensive sources of data for the global forex market, the April 2016 Triennial Survey on foreign exchange and OTC derivatives trading by the Bank for International Settlements (BIS).

The BIS’s Triennial Survey produces data on the volume of forex trading, which is used by market analysts around the world, as well as historical data dating back to 1996 depicting how the forex market has expanded both in size and geographical range over the years. Furthermore, the BIS is currently scheduled to release an updated forex market survey for April 2019, with results being released in September of 2019 for forex turnover. This will then be followed in November 2019 with an account for the outstanding forex amounts, with the full 2019 Triennial Survey report then scheduled for release in December 2019

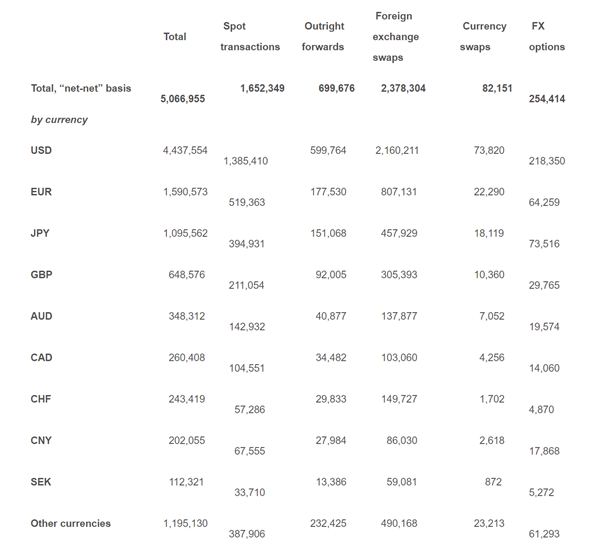

The Size of the Forex Market by Currency and Currency Pair

As of April 2016, the largest volume of any currency traded was the US dollar, which accounted for 87.8% of total forex trading volume, and only slightly above its share of 87% of traded volume in 2013. The second most popular traded currency was the euro, the consolidated currency of the European Union (EU), composing 31.3% of the total traded volume. Here, the euro showed a slight decline in trading from 2013’s 33.4% registered volumes. In third was the Japanese yen with a market share of 21.6%, a slight decrease from 23.1% in 2013, followed behind in fourth by the UK’s pound sterling, which held a market share of 12.8% in 2016, up 1% from the 11.8% observed in 2013.

With respect to the volume of currency pairs traded, the EUR/USD pair scored the highest in 2016 with a trading volume share of 23% on a net-net basis, down from 24.1% in 2013. A close second was the USD/JPY pair with a 17.7% share in 2016, which also fell from its 18.3% share seen in 2013’s survey.

Other major currency pairs include GBP/USD, AUD/USD, USD/CAD, USD/CNY and USD/CHF, which are listed in declining order of their trading volume share.

Forex Market Turnover by Instrument

When it comes to the popularity of instruments traded in the forex market, the highest amount of forex market turnover occurs in foreign exchange swap transactions. As per the BIS survey in April 2016, the daily average amount of foreign exchange swaps traded was $2.37 trillion. Furthermore, the next most popular instrument for forex traders were spot transactions with a total of $1.65 trillion being traded in April 2016. These instruments were followed in popularity by forward out rights, forex options and currency swaps.

| OTC Forex Turnover by Instrument in April 2016 |

| Daily averages, in millions of US dollars |

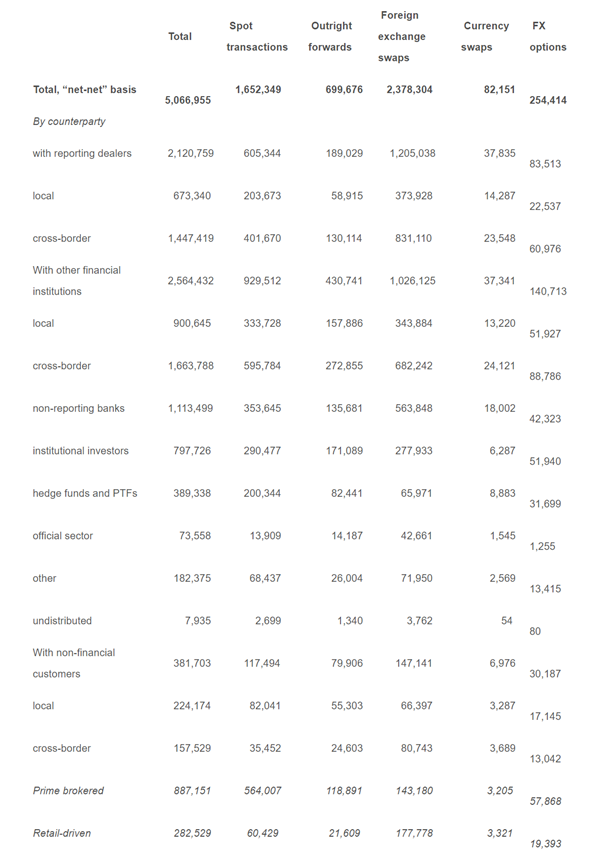

Forex Turnover of the Various Forex Market Participants

In 2016, the types of forex market participant that had the largest foreign exchange market turnover were reporting dealerships. These handed over more than $2.1 trillion in purchase quantity, with other financial institutions accounting for the continuing to be day-to-day turnover of $2.5 trillion.

In contrast, prime brokered deals totaled up to $887 billion and non-financial customers only passed on $381 billion as of April 2016. Moreover, hedge funds and also proprietary trading firms (PTFs) had a purchase quantity of $389 billion, while retail forex purchases made up an also smaller quantity of $282 billion of the total foreign exchange market turnover in that month.

| OTC Forex Turnover by Counterparty in April 2016 |

| Daily averages, in millions of US dollars |

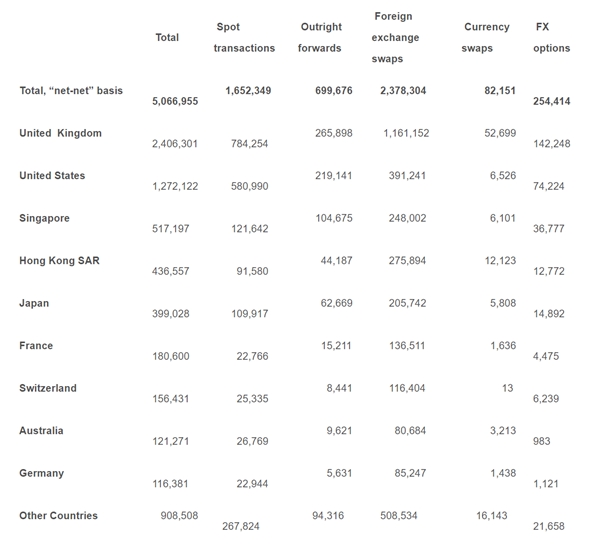

Countries with the Biggest Forex Market Transaction Volume

Foreign exchange market purchase volumes vary substantially among nations that hold significant varieties of foreign exchange market participants. By far, the biggest geographical centre for foreign exchange trading is the UK with greater than $2.4 trillion traded on average every day in April 2016.

As a matter of fact, the UK’s trading quantity represented practically half of the $5.06 trillion typical day-to-day quantity traded throughout that period.

The country with the second-largest foreign exchange trading volume is the USA with an average day-to-day transaction quantity of $1.27 trillion. That impressive turnover was followed by a number of Oriental countries, with Singapore, Hong Kong SAR and also Japan revealing average day-to-day quantities of $517 billion, $436 billion and $399 billion respectively.

On the whole, the fx sales workdesks and also systems located in simply the 5 nations mentioned above negotiated 77%of all fx professions done in April 2016.

| OTC Forex Turnover by Country in April 2016 |

| Daily averages, in millions of US dollars |

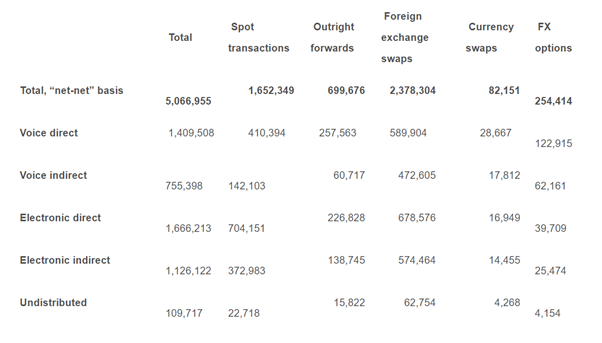

OTC Forex Market Turnover by Execution Method

The most common forex transaction execution method was via electronic direct services, which accounted for the highest amount of forex market turnover totalling $1.66 trillion traded according to BIS’s April 2016 report. The second most common trading method was through voice direct, which reached a daily average of $1.40 trillion in forex transactions. This was followed in popularity by electronic indirect transactions of $1.12 trillion.

The least common execution type consists of the voice indirect method with only $755 billion in average daily transactions. Whilst, undistributed trade executions accounted for only $109 billion on average per day.

| OTC Forex Turnover by Execution Method in April 2016 |

| Daily averages, in millions of US dollars |

How Forex Traders Benefit from Trading a Large Market

The sheer size of the forex market, and its correspondingly large number of professional and retail participants, are the key contributing factors to the high degree of liquidity that the forex market offers. Additionally, due to these factors, the foreign exchange market is much harder for big financial institutions and traders to manipulate and influence. Nevertheless, it is possible for central banks to sometimes shift the market by using their large currency reserves.

Additionally, market shocks do still sometimes occur in affected currency pairs due to unanticipated news events. A classic example was the so-called Swiss Shock in January 15, 2015 when Switzerland pulled out of its managed exchange rate regime that had placed a ceiling on the Swiss franc value relative to the EU’s euro. This surprise announcement by the Swiss National Bank resulted in a sharp spike higher for the franc, resulting in drastic profit and losses for forex traders and financial institutions.

Overall, the forex market’s large size, depth and high liquidity means that big trades do not generally solely cause excessive exchange rate moves in the market, contributing towards unwelcome volatility and unanticipated trading losses.

Website:www.flashtrade1.com

Twitter:twitter.com/flashtrade11

Telegram:telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram:www.instagram.com/flashtrade1/

You Tube:www.youtube.com/FlashTrade1

Skype:flashtrade1@outlook.com

Mail ID:info.flashtrade@gmail.com