Cross Currency Pairs

It’s time to clear up some confusion I see quite often around the web regarding small pairs and currency crosses.

A currency cross is any set that does not include the US dollar. As such, these pairings do not provide almost as much liquidity as the majors we went over previously.

A small set, on the other hand, is a major currency cross. As you now understand, a cross doesn’t include the US dollar. Therefore, these minors are consisted of the Euro (EUR), British pound (GBP) and the Japanese yen (JPY).

If it’s all a little fuzzy at the moment, don’t fret. The tables below need to help to clear things up

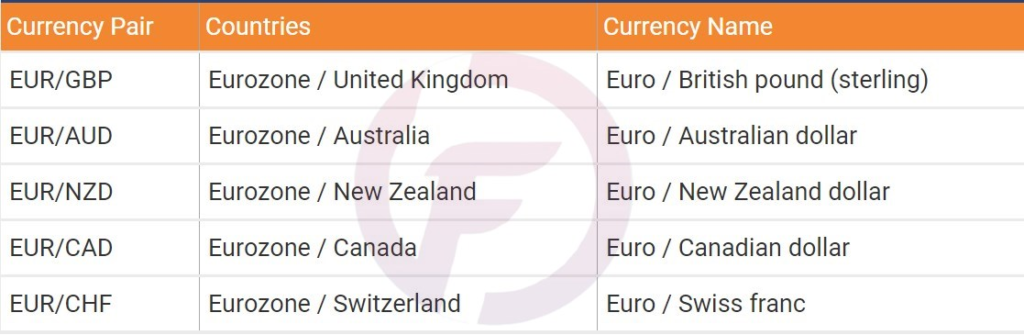

Euro Crosses

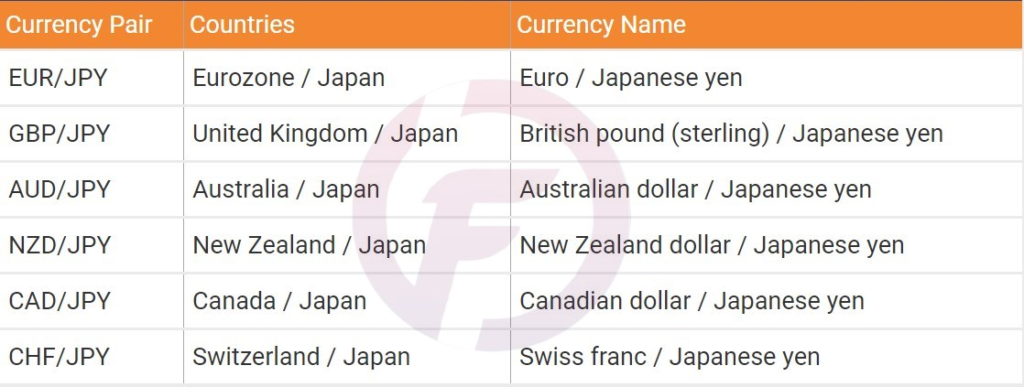

Japanese Yen Crosses

British Pound Crosses

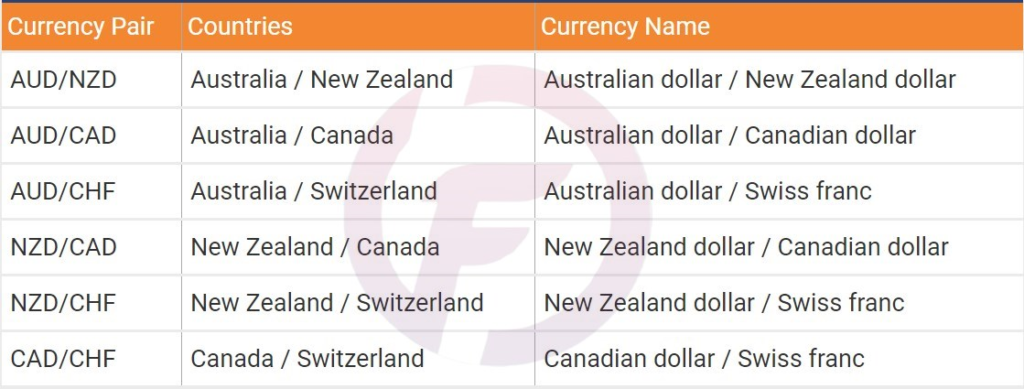

Other Crosses

However if the major currency pairs get the majority of the attention and bring the most liquidity, why would anybody wish to trade small currency sets and particularly crosses?

Make no mistake, while the day-to-day volume for these crosses is less than the majors, they are definitely not illiquid by any means.

In fact, much of the significant crosses average more day-to-day volume than some stock exchanges.

Keep in mind that the foreign exchange market is the most liquid financial market on the planet, so even some of the less popular currencies are extremely liquid.

A minor set, on the other hand, is a major currency cross. As you now know, a cross doesn’t include the United States dollar. These minors are made up of the Euro (EUR), British pound (GBP) and the Japanese yen (JPY).

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com