What is spot trading?

An spot trade, likewise referred to as an spot transaction, can be specified as an acquisition or sale of an equity, foreign currency, product, or other financial property which is due to be instantly delivered on a specific area date.

An spot deal suggests a physical exchange of a monetary instrument with immediate shipment. An spot market is likewise called a physical or cash market, because cash payments are processed with no delay.

Numerous financial properties quote a “spot rate” and a “forward or futures cost”, taking into account the worth of the payment based upon the time to maturity and rate of interest.

Spot trading described

orex contracts are thought about the most typical kind of spot trading and are typically defined for delivery throughout two organization days (i.e. T +2). The majority of other financial properties settle the next company day.

The spot foreign exchange market– Forex– trades digitally worldwide round the clock. Forex represents the largest international market with a day-to-day trading volume of more than $6 trillion.

Financial assets traded on the spot market consist of not only forex pairs, however stocks and fixed-income instruments, such as treasury expenses and bonds. Commodities also play an important role in spot markets, as investors open spot trades on energy, metals, farming and livestock.

The existing cost of a financial possession is called the spot price. It is the rate at which a trader can buy or sell the instrument instantly. To produce the area price, sellers and purchasers publish their buy and sell orders on the marketplace If the marketplace is liquid, the area price can change in a matter of seconds, due to the fact that exceptional orders are filled and new orders go into the marketplace.

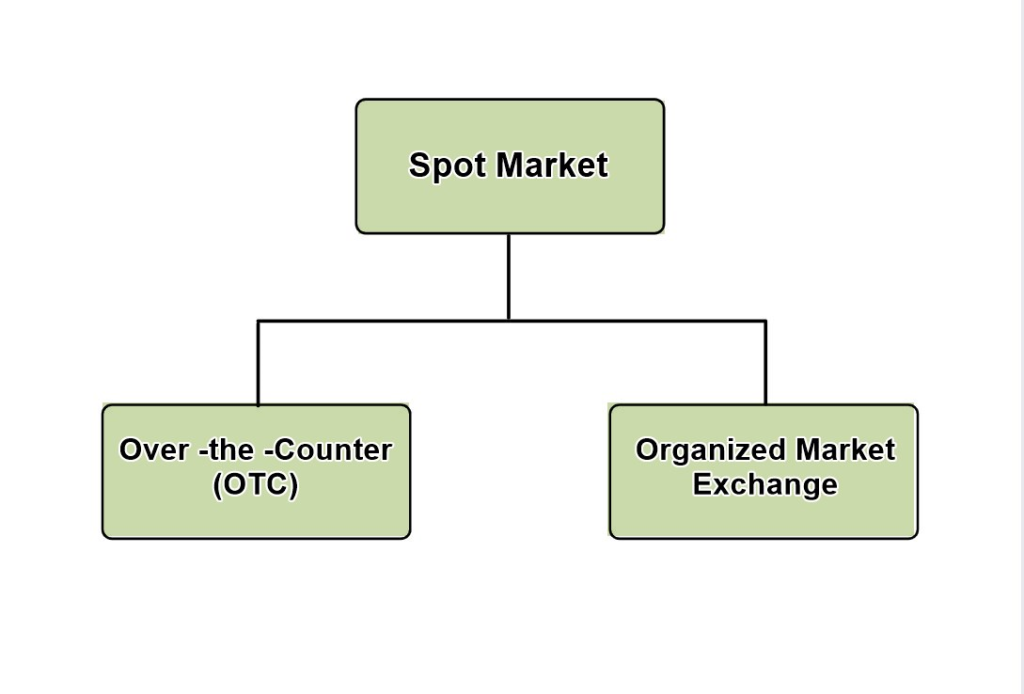

Types of spot trading market

There are two major types of spot market: organized market exchanges and non-prescription (OTC) markets.

Over-the-counter (OTC) is a market where buyers and sellers satisfy to trade through a mutual bilateral arrangement without a third-party manager to manage the trade. Possessions traded on the OTC market can differ in regards to rate or amount from the requirements of standard exchanges. OTC trades are mostly personal and rates may be not disclosed.

Market exchange is an arranged market where buyers and sellers bid and trade offered monetary properties. Trading can be carried out on a trading flooring or on an electronic trading platform. Electronic trading helped with the trading procedure as prices are set instantly and a big variety of trades are made at the same time.

Exchanges can handle several monetary instruments or they may specialize on one specific kind of possession. The New York Stock exchange (NYSE) trades mainly in stocks, while Chicago Mercantile Exchange Group (CME) offers mainly commodities. Stock exchanges are regulated and all the trading procedures are standardized.

The present price of a monetary property is called the area cost. If the market is liquid, the spot cost can change in a matter of seconds, since outstanding orders are filled and brand-new orders enter the marketplace.

Assets traded on the OTC market can vary in terms of price or quantity from the requirements of conventional exchanges. Trading can be carried out on a trading floor or on an electronic trading platform. Electronic trading assisted in the trading procedure as costs are set instantly and a huge number of trades are made at the very same time.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com