What does rollover mean in the context of the forex market?

In the forex (FX) market, rollover is the process of extending the settlement date of an employment opportunity. In most currency trades, a trader is required to take shipment of the currency 2 days after the deal date. Nevertheless, by rolling over the position– concurrently closing the existing position at the daily close rate and re-entering at the new opening rate the next trading day– the trader artificially extends the settlement duration by one day.

Rolling Over FX Positions

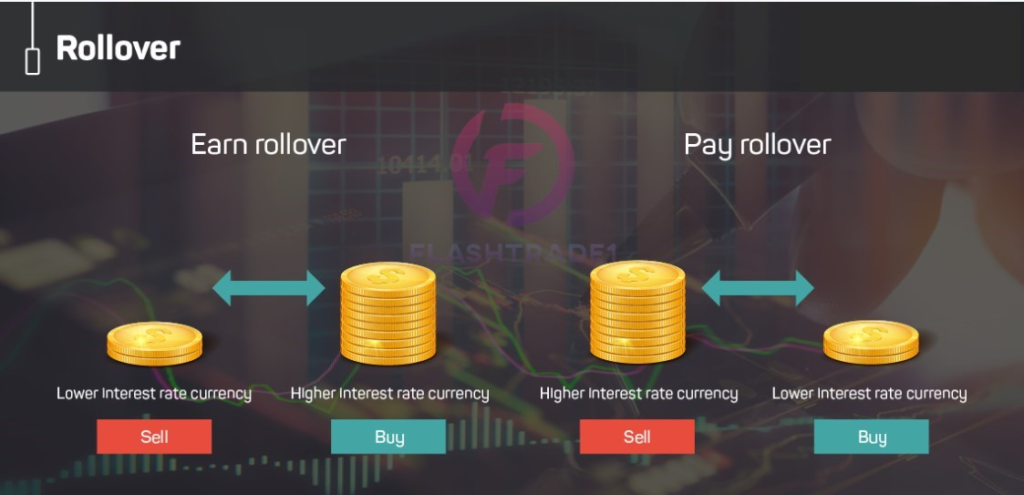

Long-lasting forex day traders can make money in the market by trading from the positive side of the rollover formula. Traders start by computing swap points, which is the difference in between the forward rate and the spot rate of a particular currency pair as revealed in pips. Traders base their estimations on rate of interest parity, which implies that investing in varying currencies must result in hedged returns that are equivalent, no matter the currencies’ rates of interest.

Traders calculate the swap points for a certain shipment date by thinking about the net advantage or expense of providing one currency and loaning another against it during the time in between the spot value date and the forward delivery date. Therefore, the trader makes money when he is on the positive side of the interest rollover payment.

Rollover Credit

Frequently referred to as tomorrow next, rollover is useful in FX since numerous traders have no intent of taking delivery of the currency they buy; rather, they wish to make money from changes in the currency exchange rate. Considering that every forex trade involves borrowing one nation’s currency to purchase another, paying and receiving interest is a regular incident. At the close of every trading day, a trader who took a long position in a high-yielding currency relative to the currency that they obtained will get an amount of interest in their account.

On the other hand, a trader will require to pay interest if the currency they borrowed has a greater rate of interest relative to the currency that they bought. Traders who do not want to gather or pay interest should close out of their positions by 5 P.M. Eastern.

Keep in mind that interest received or paid by a currency trader in the course of these forex trades is regarded by the Internal Revenue Service as ordinary interest income or expense. For tax functions, the currency trader should track interest got or paid, different from regular trading gains and losses

In most currency trades, a trader is required to take shipment of the currency two days after the deal date. Traders base their computations on interest rate parity, which indicates that investing in differing currencies need to result in hedged returns that are equal, regardless of the currencies’ interest rates.

At the close of every trading day, a trader who took a long position in a high-yielding currency relative to the currency that they obtained will get an amount of interest in their account.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com