Types of Price Charts

Let’s have a look at the 3 most popular types of price charts:

— Line chart

— Bar chart

— Candlestick chart

Now, we’ll describe each of the forex charts, and let you know what you must learn about each of them.

Line Chart

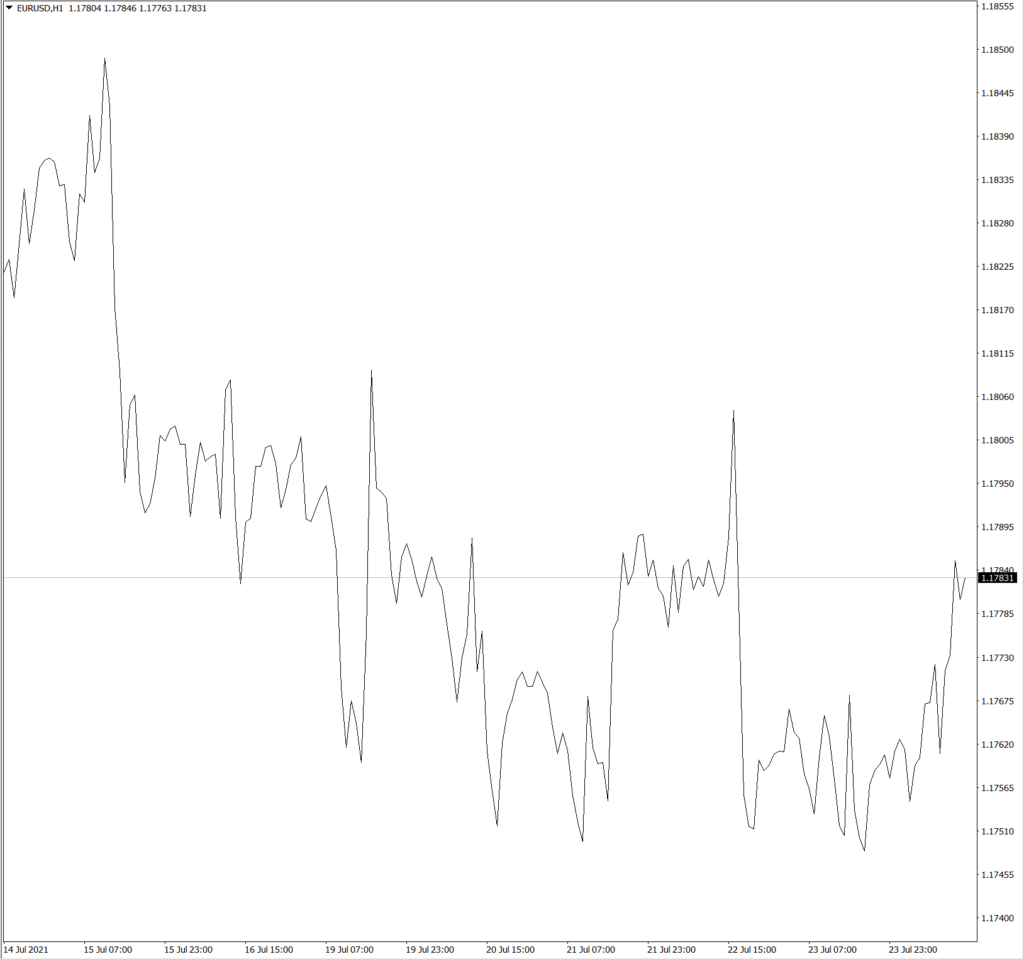

An easy line chart draws the line from one closing price to the next closing price.

When strung together with a line, we can see the general cost motion of a currency pair over a time period.

It’s easy to follow, however the line chart might not offer the trader with much information about price habits within the period.

All you understand is that rate closed at X at the end of the period. You have no clue what else occurred.

However it does assist the trader see trends more quickly and aesthetically compare the closing cost from one period to the next.

This type of chart is generally used to get a “broad view” view of rate movements.

The line chart likewise reveals patterns the very best, which is merely the slope of the line.

Some traders consider the closing level to be more vital than the open, high, or low. By paying attention to only the close, price changes within a trading session are neglected.

Here is an example of a line chart for EUR/USD:

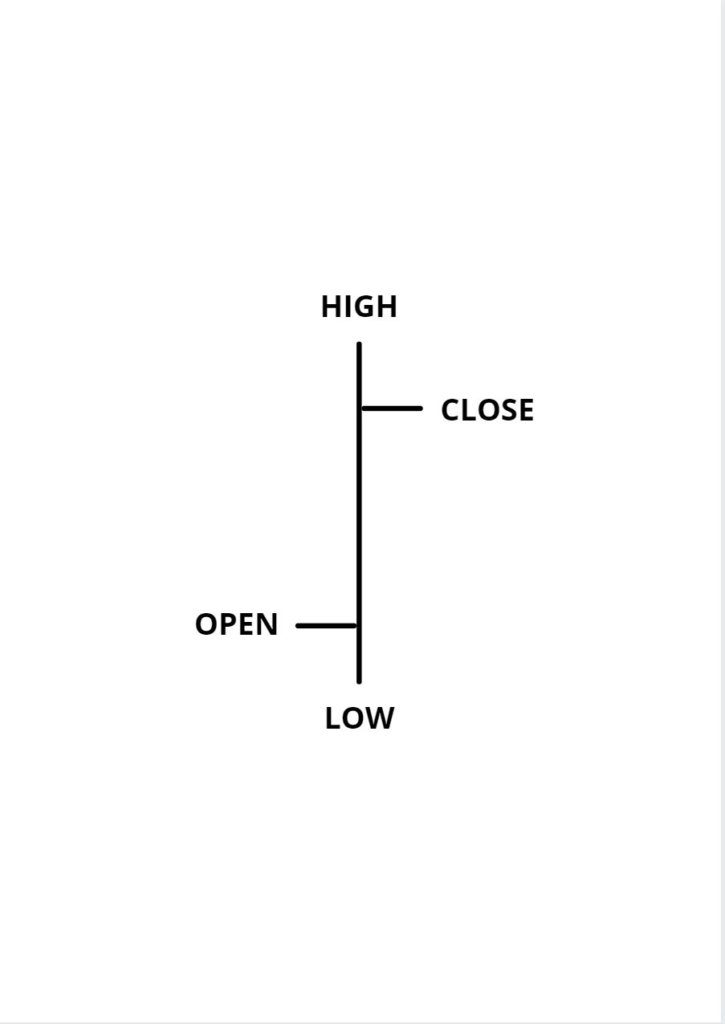

Bar Chart

A bar chart is a little bit more complex. It reveals the opening and closing costs, along with the lows and highs.

Bar charts help a trader see the rate series of each period.

Bars may increase or reduce in size from one bar to the next, or over a range of bars.

The bottom of the vertical bar suggests the most affordable traded cost for that time duration, while the top of the bar indicates the greatest price paid.

The vertical bar itself shows the currency set’s trading range as a whole.

As the price changes end up being increasingly unpredictable, the bars end up being larger. As the cost fluctuations end up being quieter, the bars become smaller.

The fluctuation in bar size is because of the way each bar is constructed. The vertical height of the bar reflects the variety in between the high and the low price of the bar period.

The price bar also records the period’s opening and closing prices with attached horizontal lines.

The horizontal hash on the left side of the bar is the opening cost, and the horizontal hash on the best side is the closing price.

Here is an example of a bar chart for EUR/USD:

Remember, throughout our lessons, you will see the word “bar” in reference to a single piece of data on a chart.

A bar is just one section of time, whether it is one day, one week, or one hour.

When you see the word ‘bar’ moving forward, make certain to comprehend what timespan it is referencing.

Bar charts are likewise called “OHLC” charts due to the fact that they suggest the Open, the High, the Low, and the Close for that particular currency set.

A big difference in between a line chart and an OHLC (open, high, low, and close) chart is that the OHLC chart can reveal volatility.

Open: The little horizontal line left wing is the opening cost

High: The top of the vertical line specifies the greatest price of the time duration

Low: The bottom of the vertical line defines the most affordable price of the time period

Close: The little horizontal line on the right is the closing rate

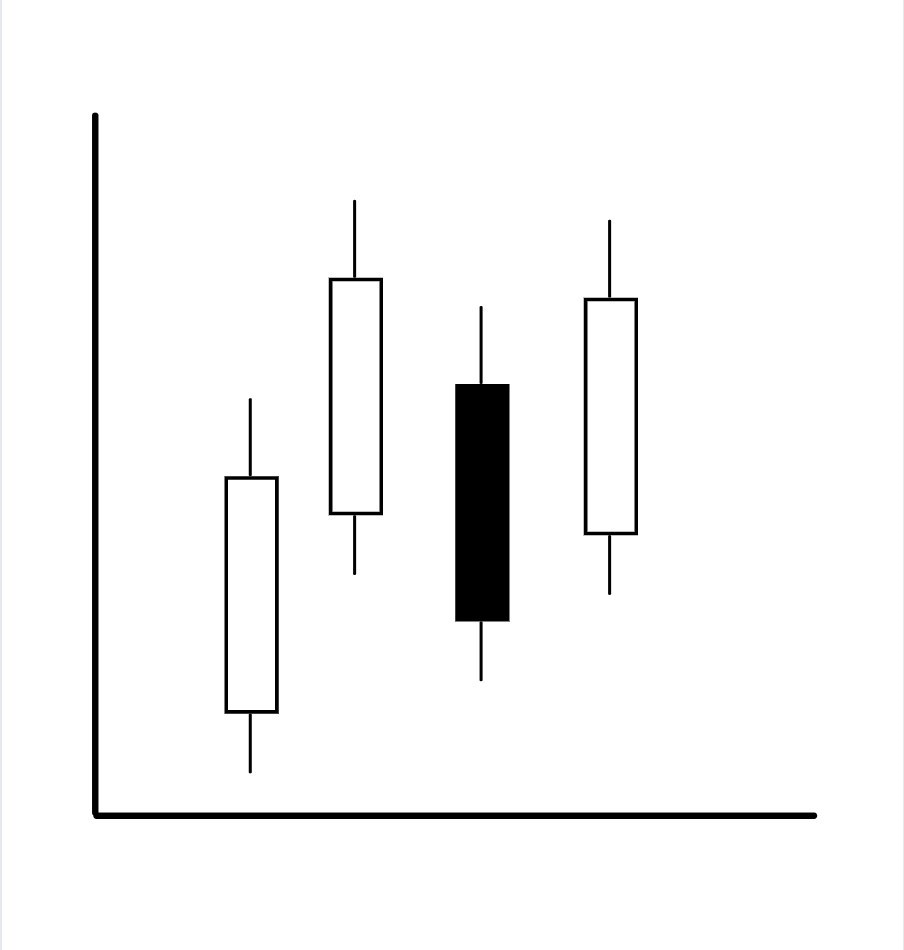

Candlesticks Charts

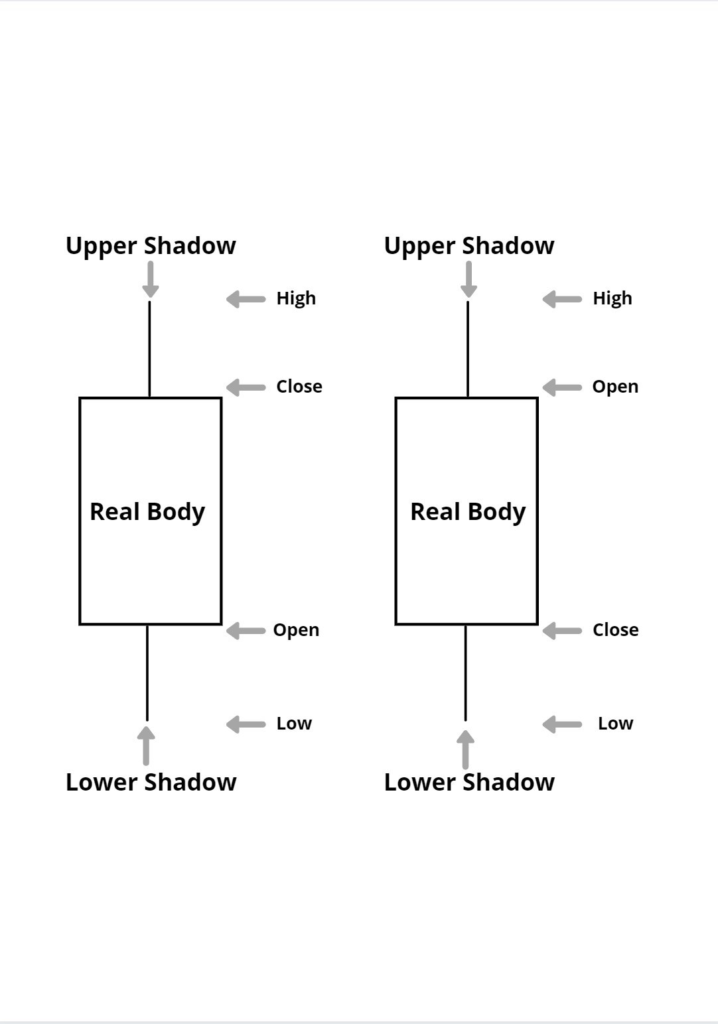

The candlestick chart is a variation of the bar chart.

Candlestick charts show the very same price details as a bar chart however in a prettier, graphic format.

Numerous traders like this chart due to the fact that not only is it prettier, however it’s much easier to check out.

Candlestick bars still show the high-to-low variety with a vertical line.

In candlestick charting, the larger block (or body) in the middle indicates the range between the opening and closing costs.

Candlesticks assist imagine bearish or bullish sentiment by displaying “bodies” using different colors.

Typically, if the block in the middle is filled or colored in, then the currency pair closed LOWER than it opened.

In the copying, the ‘filled color’ is black. For our ‘filled’ obstructs, the top of the block is the opening rate, and the bottom of the block is the closing price.

If the closing cost is higher than the opening rate, then the block in the middle will be “white” or unfilled or hollow.

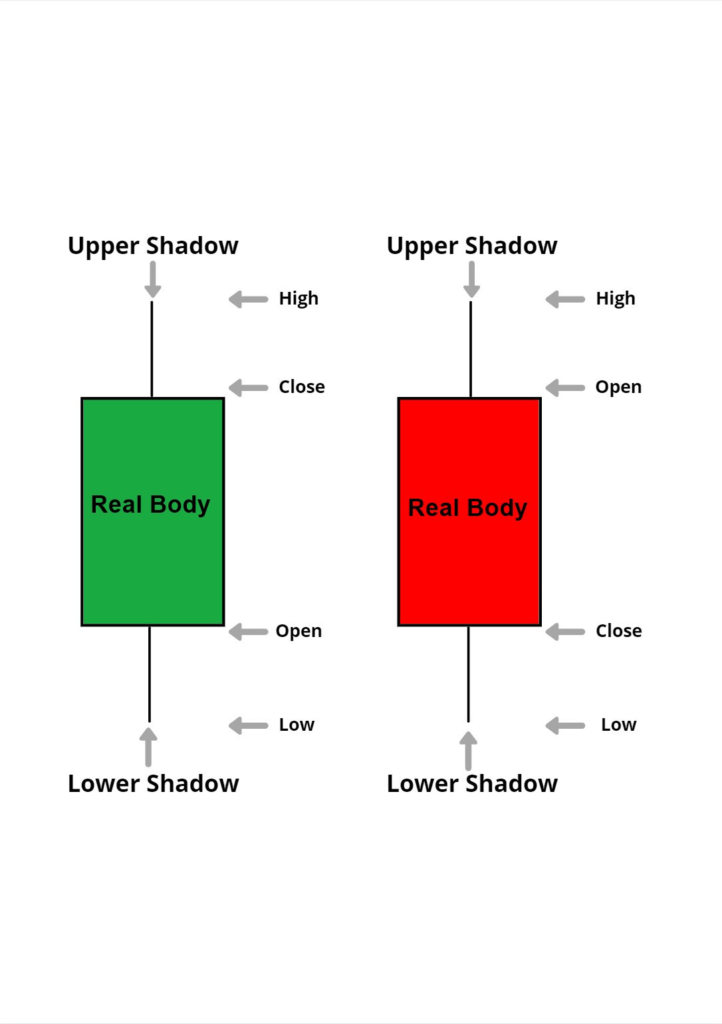

We merely replaced green instead of white, and red instead of black. This suggests that if the price closed higher than it opened, the candlestick would be green.

If the price closed lower than it opened, the candlestick would be red.

In our later lessons, you will see how using green and red candles will enable you to “see” things on the charts much faster, such as uptrend/downtrends and possible reversal points.

For now, simply keep in mind that on forex charts, we use red and green candlesticks instead of black and white and we will be using these colors from now on.

Here is an example of a candlestick chart for EUR/USD.

The purpose of candlestick charting is strictly to work as a visual aid considering that the precise same information appears on an OHLC bar chart.

The advantages of candlestick charting are:

Candlesticks are easy to translate and are a good place for beginners to begin finding out chart analysis.

Candlesticks are easy to use! Your eyes adapt practically instantly to the info in the bar notation. Plus, research study shows that visuals assist with studying, so it might assist with trading as well!

Candlesticks and candlestick patterns have cool names such as the “shooting star,” which helps you to remember what the pattern means.

Candlesticks are good at identifying market turning points– trend reversals from an uptrend to a drop or a downtrend to an uptrend. You will learn more about this later.

There are many different kinds of charts readily available, and one is not always much better than the other.

The information may be the same to develop the chart however the way that information is presented and analyzed will differ.

Each chart will have its own benefits and downsides. You can pick any type or use several kinds of charts for technical analysis. It all depends on your individual preference.

Now that you know why candlesticks are so cool, it’s time to let you understand that we will be using candlestick forex charts for the majority of, if not all of forex chart examples on this site.

Candlesticks are easy to utilize! Your eyes adapt nearly instantly to the information in the bar notation. Plus, research study shows that visuals help with studying, so it may help with trading!

Each chart will have its own advantages and downsides. You can choose any type or utilize several types of charts for technical analysis.

WHERE TO CONTACT US:

Website: www.flashtrade1.com

Twitter: twitter.com/flashtrade11

Telegram: telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram: www.instagram.com/flashtrade1/

You Tube: www.youtube.com/FlashTrade1

Skype: flashtrade1@outlook.com

Mail ID: info.flashtrade@gmail.com