History of crude oil in forex market

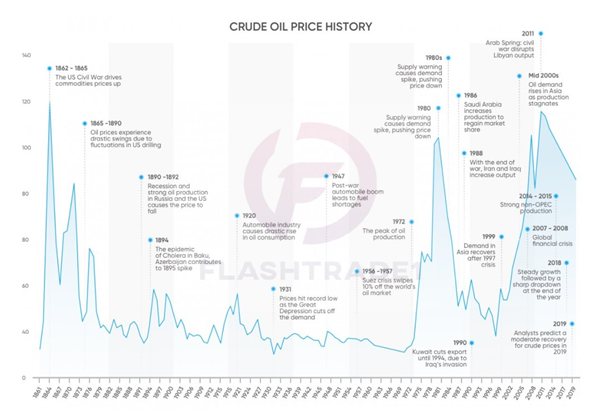

Like most other commodities in the markets, crude oil prices have routinely experienced wild price swings alternating between times of great shortages, high demand and high prices and periods of oversupply, low demand and depressed prices.

What is crude oil?

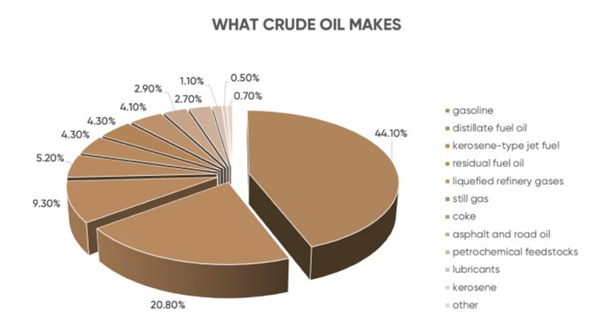

Why crude oil is so valuable

Today, crude oil and its derivatives are the most-traded commodities in the world. This highly valuable and significant resource serves as a popular financial instrument, commonly used for hedging, portfolio diversification and price speculation.

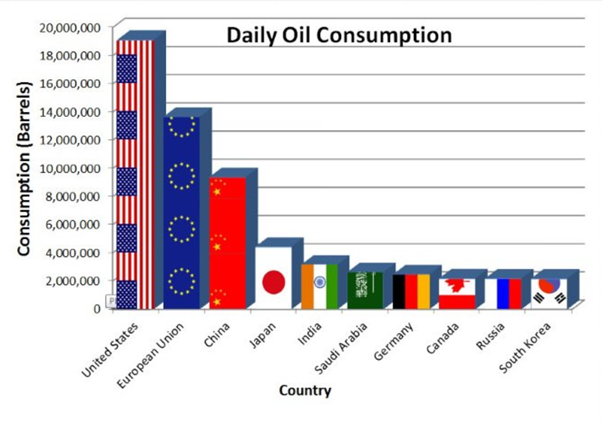

Oil consumption: global statistics

According to the International Energy Agency (IEA), the total global consumption of oil is approximately 93 million barrels per day. The world’s top 10 major oil consuming countries are the following:

Crude oil price history

With each passing year, oil seems to play an even greater role in the global economy. In the early days, finding oil during a drill was considered somewhat of a nuisance as the intended treasures were normally water or salt. It wasn’t until 1847 that the first commercial oil well was drilled in the Absheron Peninsula, Azerbaijan.

The U.S. petroleum industry was born 12 years later, in 1859, with intentional drilling near Titusville, Pennsylvania. (Drilling in the United States began in the early 1800s, but they were drilling for brine so any oil discovery was accidental.)

While much of the early demand for oil was for kerosene and oil lamps, it wasn’t until 1901 that the first commercial well capable of mass production was drilled at a site known as Spindletop in south-eastern Texas. This site produced more than 100,000 barrels of oil in one day, more than all the other oil-producing wells in the United States combined.

Many would argue that the modern oil era was born that day in 1901, as oil was soon to replace coal as the world’s primary fuel source.

The use of oil in fuels continues to be the primary factor in making it a high-demand commodity around the globe, but how are prices determined?

In terms of historical price action, crude oil hit its all-time high of $145.31 per barrel in July 2008. The commodity’s record low of $1.17 happened in February 1946. In 2018, the average US crude price was fluctuating around $67.22. The latest crude oil price as of 21 February 2019 was $57.46.

Crude oil price history: let’s explore some major historical events that influenced crude oil trading.

Oil Industry Information

MarketWatch: MarketWatch provides “business news, personal finance information, real-time commentary, investment tools, and data.”16 Due to this diversity, it might not necessarily stand out as targeting oil, but it is always one of the first to break stories, putting out headlines as soon as news hits. These headlines can be found at the top right of its home page under the tab “Latest News.” MarketWatch also provides details when necessary, posting stories, sometimes only a paragraph or two, to elaborate on its headlines, and updating them throughout the day.17The site provides current oil price information, stories detailing oil’s price path—including pre-market and closing bell commentary—and multiple feature articles. The company has an active link on its landing page showing the price of WTI.17 Within most articles, MarketWatch also includes an active link to the price of oil, so when you read an article the price quote included is current.18In addition, MarketWatch offers a more in-depth analysis of the economic news driving oil prices.

Reuters Commodities Page: The Reuters news service has a commodity-specific portion of its website that releases breaking oil news, background stories, and current prices. It also offers more recent in-depth stories on, and analysis of, the sector as a whole, including price-driving sector updates (it’s superior to MarketWatch in this regard) and is good at releasing any imperative news as it is made public. Reuters also publishes frequent pieces detailing oil’s price movements and factors behind those movements.19

CNBC: CNBC.com has a webpage dedicated to oil news. During U.S. market hours, it publishes relevant oil-specific pieces. This works out to be about every hour when you look at its main page. CNBC frequently updates its articles when there is a price movement in oil, but it does not provide a live feed to oil prices like MarketWatch. It makes up for this, though, by providing a good breadth of oil sector stories including all major price movers and price-driving developments.

What drives crude oil prices?

Loading…

Loading…

How to Invest in Crude Oil?

To an investor, crude oil can be a speculative asset, a portfolio diversifier, or a hedge against related positions. There are two ways to invest in crude oil: futures contracts and spot contracts. The price of the spot contract reflects the current market price for oil, whereas the futures price reflects the price buyers are willing to pay for oil on a delivery date set at some point in the future. Most commodity contracts that are bought and sold on the spot markets take effect immediately – money is exchanged, and the purchaser accepts delivery of the goods. A futures contract is an agreement to buy or sell a certain number of barrels of oil at a predetermined price, on a predetermined date.

Reasons to Trade Crude Oil

Oil is a dynamic, volatile and liquid market – and stands as the most traded commodity in the world. Here’s more on the benefits of engaging with this asset.

The volatile nature of trading this asset makes it a favorite of swing and day traders, who react to the latest oil pricing news. While the trading can be risky, some see the oil market as an opportunity in its purest form.

Crude oil is a liquid market, traded in huge volume. This means trades can be opened and closed at the price points you want and at lower trading cost.

Oil can be traded as part of a hedging strategy to mitigate against the effects of the asset’s volatility.

Trading oil can be part of a diversified portfolio of commodities, stocks and bonds.

Website:www.flashtrade1.com

Twitter:twitter.com/flashtrade11

Telegram:telegram.me/ft113

Facebook: www.facebook.com/FlashTrade1

Instagram:www.instagram.com/flashtrade1/

You Tube:www.youtube.com/FlashTrade1

Skype:flashtrade1@outlook.com

Mail ID:info.flashtrade@gmail.com